Displaying items by tag: tax credits

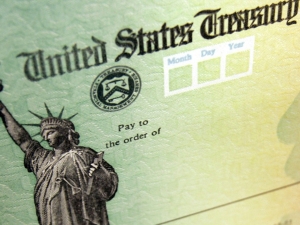

Coronavirus Stimulus Package: What You Need to Know

The IRS plans to provide the stimulus payments to individuals and families by depositing funds directly into the same banking account reflected on the latest tax return filed.

Jackson Hewitt HQ, April 1, 2020 – As the federal government manages its response to the coronavirus epidemic, a variety of solutions including extending the federal tax deadline for filing and payments, implementing paid leave for workers and tax credits for small businesses, and most recently, passing a two trillion dollar stimulus plan to bolster the U.S. economy were implemented. As a part of the recently passed stimulus, Americans should receive a stimulus check in the near future. Some of the most common questions regarding the pending stimulus checks are answered below:

Remember the Earned Income Tax Credit on EITC Awareness Day

One in five people miss out on the important tax credit – worth up to $6,557 for a family of five

JERSEY CITY, NJ, January 31, 2020 – A recent Jackson Hewitt Tax Service® survey, conducted by Dynata, shows that 44% of respondents who make less than $40,000 are not even aware of one of the biggest tax credits available to hard-working taxpayers, the Earned Income Tax Credit (EITC), and 37% of total respondents were unsure if they were eligible to claim it.

To better educate those who are eligible to claim the EITC, Jackson Hewitt is participating in the 14th annual EITC Awareness Day on January 31. At Jackson Hewitt locations nationwide, local Tax Pros will advise their clients on the credit to ensure they get the biggest tax refund available to them.

Featured Content

- Social Security Recipients to Automatically Receive Stimulus Checks

- Coronavirus Stimulus Package: What You Need to Know

- How will COVID-19 (Coronavirus) Affect the Tax Filing Deadline?

- Economic Impact Payments: What You Should Know

- March 24, 2020 - Press Release

- Five Major Life Changes That Can Impact Taxes

- Remember the Earned Income Tax Credit on EITC Awareness Day